Early Financial Planning Helps Women Overcome Disadvantages

While women have made great strides in financial parity, a few factors still keep them from achieving the same success as men. Lower wages, fewer assets, and less financial knowledge are systemic issues that work to keep women at a disadvantage.

Fortunately, you can take an active role in growing your wealth and overcoming the obstacles that society has created. The key to becoming an outlier in the conversation surrounding gender financial gaps is to understand them and implement an effective financial plan as soon as possible.

The Gender Wage Gap Makes Proactive Money Management Vital

A widely known but unfortunate reality is that women, on average, still earn less than men, with some estimates showing that women are paid between 2 and 6% less for the same job. Women are also more likely to have familial responsibilities that limit their career progression, overtime work, and lifetime pay.

Lower income too often translates to lower savings – with women saving less than half the amount of their male counterparts in 2023. One explanation for this trend is women spend a larger portion of their budget on essentials. For example, Capital One Shopping research shows that women spend 40.7% of their after-tax income on housing compared to 37.7% for men.

The wage gap significantly impacts women’s budgets, but disciplined money management can help overcome a lifetime of lower earnings. One way that you can do this in your own life is by prioritizing future financial success as early as possible.

With an early start to financial planning, you can develop a clear plan and start to put money away for the future. This gives you decades of potential investment earnings to grow your nest egg and help your wealth keep pace with higher-earning men.

The Gender Wealth Gap Puts Women at a Disadvantage

Beyond the disparity in salaries, there is a lesser-known, but equally significant, issue – the gender wealth gap. This is the difference in total wealth between men and women.

The Federal Reserve Bank of St. Louis reported that women owned just 28% of all household wealth in 2024. This wealth disparity is just another factor that shows women are often starting from behind in the financial game.

Early planning allows you to leverage the power of time to build your wealth. Through careful planning and investing, you can grow your assets, pass them on to your daughters, and play an active role in closing the wealth gap.

Taking An Active Role in Financial Planning Helps Close the Knowledge Gap

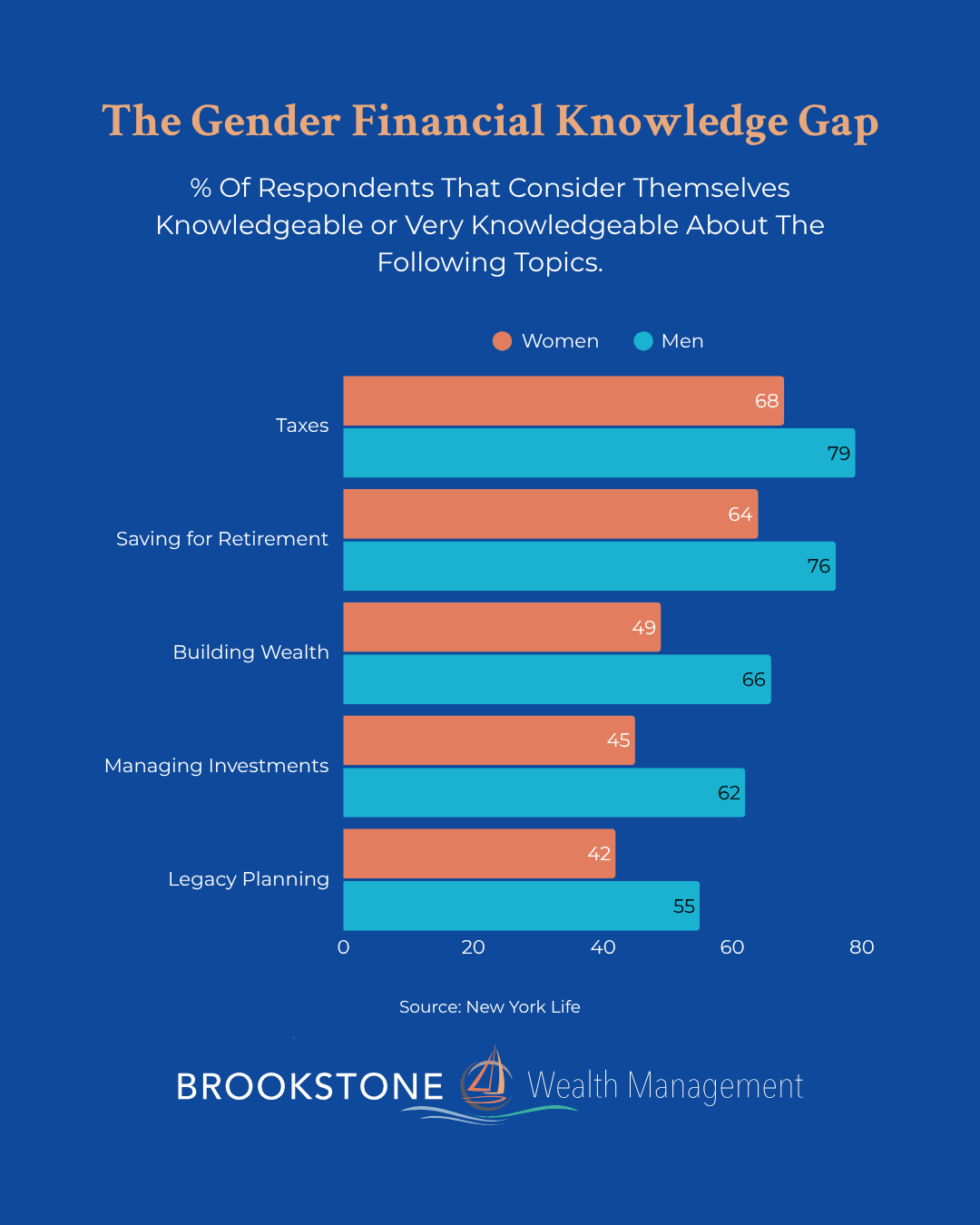

Another factor that works to prevent women from achieving success is the financial knowledge gap. A recent survey from New York Life found that women, on average, have less financial knowledge and confidence than their male counterparts.

The following graph summarizes the findings.

Fortunately, the knowledge gap is the easiest of the gender financial gaps to close. You can start early and build your financial acumen by seeking financial planning assistance from a financial advisor who focuses on coaching, teaching, and mentoring clients.

Compound Returns Make Early Saving More Rewarding

The incredible power of compound returns – also called compound growth – make early financial planning an important and rewarding endeavor for women. Those who save a modest amount each month, and make wise investment choices, can grow their nest egg over time and reduce the overall amount they need to save.

The concept is actually very simple to understand. All you need to do is start saving early, and don’t withdraw your funds until you need them.

Here’s an example of how a combination of early saving and compound returns can improve your financial success:

You start saving $500 per month at age 25 and your portfolio generates an average return of 7% per year. At age 65, you will have contributed a total of $246,000 to your savings, but compound returns have grown your portfolio to a value of over $1.2 million.

Conversely, if you started saving at age 45, you would need to contribute about $2,300 per month to achieve the same $1.2 million portfolio at age 65. In this scenario, you will have contributed a total of $603,000 to reach the same end value.

Overall, the benefits of early financial planning are clear. You gain the ability to grow your knowledge, your confidence, and your portfolio value over a lengthy period of time. These opportunities allow you to succeed, even when faced with the significant headwinds of gender disparities.

Finding the Right Support to Reach Your Financial Goals

Despite all the reasons to take control of your financial future, women still face significant challenges in creating and implementing a financial plan. One of the most significant is finding a trustworthy financial advisor who listens and understands your goals.

The right partner can help you overcome the obstacles you face and build a successful financial future. To find this ideal partner, seek a financial advisor who understands the unique hurdles that women face, is empathetic, and listens to your vision for the future.

Get Your Financial Plan from Brookstone Wealth Management

At Brookstone Wealth Management, we strive to help all our clients overcome the obstacles that prevent their financial success. Our process centers around a comprehensive wealth management program called Financial Fingerprint® that brings together the most important aspects of your financial life into one easy-to-understand plan.

When you partner with us, your financial success is supported by our experienced team of tax, legal, and investment professionals. We all put your goals at the forefront of our decisions, and work together to coach, teach, and mentor you throughout your financial journey.

Contact us today to learn more and get started.